Traduzione e analisi delle parole tramite l'intelligenza artificiale ChatGPT

In questa pagina puoi ottenere un'analisi dettagliata di una parola o frase, prodotta utilizzando la migliore tecnologia di intelligenza artificiale fino ad oggi:

- come viene usata la parola

- frequenza di utilizzo

- è usato più spesso nel discorso orale o scritto

- opzioni di traduzione delle parole

- esempi di utilizzo (varie frasi con traduzione)

- etimologia

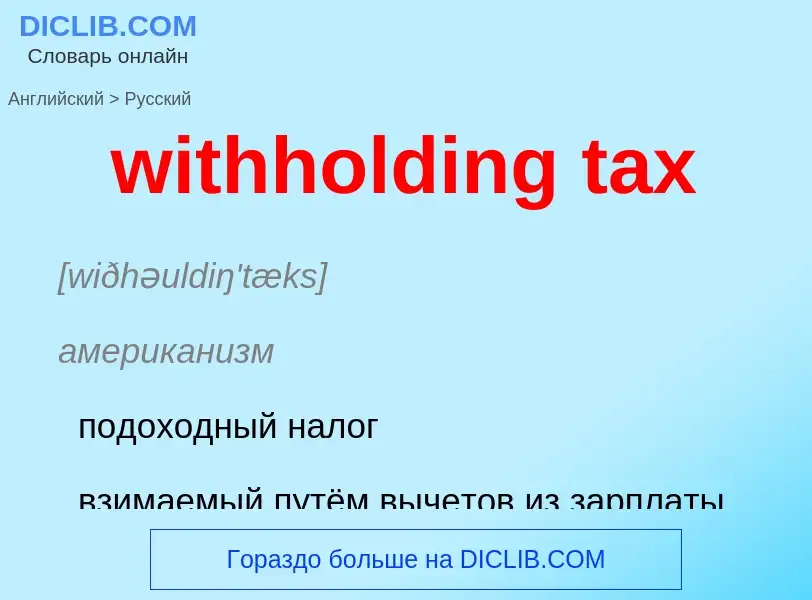

withholding tax - traduzione in russo

[wiðhəuldiŋ'tæks]

американизм

подоходный налог

взимаемый путём вычетов из зарплаты

гонорара

дивидендов и т. п.

1) подоходный налог, взимаемый путём регулярных вычетов из заработной платы

2) налог с суммы дивидендов, распределяемых среди держателей акций

Definizione

Wikipedia

Tax withholding, also known as tax retention, Pay-as-You-Go, Pay-as-You-Earn, Tax deduction at source or a Prélèvement à la source, is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the income due to the recipient. In most jurisdictions, tax withholding applies to employment income. Many jurisdictions also require withholding taxes on payments of interest or dividends. In most jurisdictions, there are additional tax withholding obligations if the recipient of the income is resident in a different jurisdiction, and in those circumstances withholding tax sometimes applies to royalties, rent or even the sale of real estate. Governments use tax withholding as a means to combat tax evasion, and sometimes impose additional tax withholding requirements if the recipient has been delinquent in filing tax returns, or in industries where tax evasion is perceived to be common.

Typically the withheld tax is treated as a payment on account of the recipient's final tax liability, when the withholding is made in advance. It may be refunded if it is determined, when a tax return is filed, that the recipient's tax liability is less than the tax withheld, or additional tax may be due if it is determined that the recipient's tax liability is more than the tax withheld. In some cases, the withheld tax is treated as discharging the recipient's tax liability, and no tax return or additional tax is required. Such withholding is known as final withholding.

The amount of tax withheld on income payments other than employment income is usually a fixed percentage. In the case of employment income, the amount of withheld tax is often based on an estimate of the employee's final tax liability, determined either by the employee or by the government.